What is a 1099-K Form? How they work and what you need to know in 2023

Maybe you’ve heard about the new changes to the 1099-K Form requirements and you’re trying to figure out if (and how) they affect you. Or maybe you’ve only recently heard about Form 1099-K for the first time and you’ve come across this article during a Googling spree. Regardless of how much you know (or don’t know) about Form 1099-K, we have the most up-to-date information about it right here, in this very article.

Essentially, on December 23, 2022, the Internal Revenue Service (IRS) announced that the 2022 calendar year will be a “transition year.” Starting next year (for 2023 taxes), any person or business who receives total payments above $600 in a given year from credit cards or third-party processing payment providers will receive Form 1099-K. For the 2022 calendar year, you will only receive a 1099-K if your gross payments exceed $20,000 and there are more than 200 transactions.

We’ll break down what this change means for you, along with whatForm 1099-K is and what it’s used for and how to set up a 1099-K-friendly bookkeeping process even the IRS would be proud of.

What is Form 1099-K?

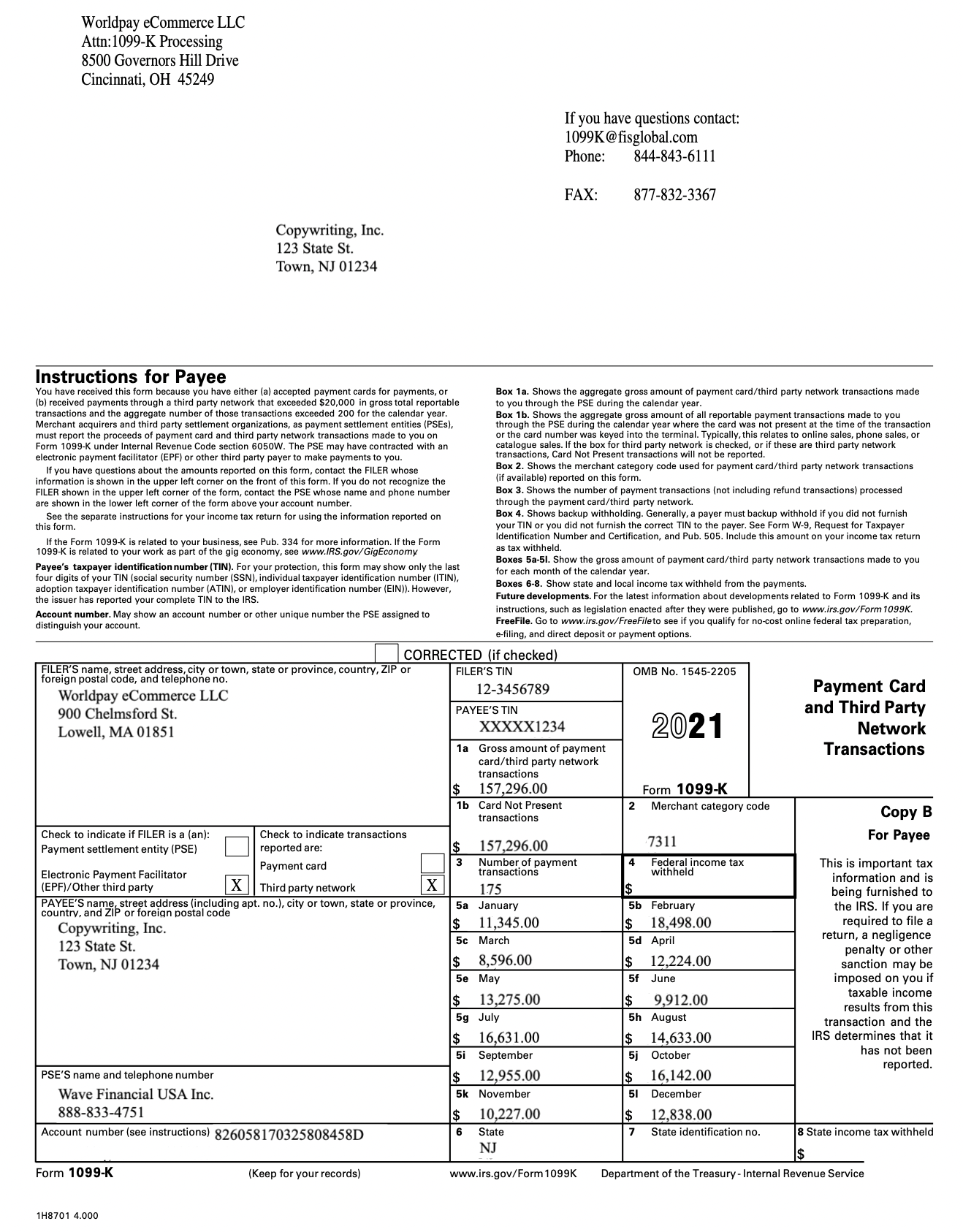

A 1099-K (Payment Card and Third Party Network Transactions) is an IRS information return that reports payments received from third-party payment settlement entities—which is a fancy way of saying platforms like Wave, Stripe, Square, Venmo, and PayPal, as well as online marketplaces (Amazon, eBay, Etsy, etc.), and credit card companies.

These networks use the 1099-K to make sure their clients (aka you, possibly!) accurately report their income on their tax returns. They fill out the 1099-K, and then provide you, the IRS, and your state with copies. You’ll receive a 1099-K, usually by January 31, if the total amount of money you received through third-party payment networks exceeded $20,000 and there were over 200 transactions for the previous calendar year.

What is the purpose of a 1099-K?

While the name might sound complicated and even a bit foreboding, the 1099-K should actually make it easier for you to stay compliant at tax time. The 1099-K is more of an “FYI”; you don’t need to do anything special, but you should use it to help you calculate your total income. It basically reports transactions and helps ensure you report your income properly. You need to report all your income (including income from these electronic payments) on your income tax return (if you don’t want to get in trouble with the IRS, that is).

Who gets 1099-K forms?

If you received more than $20,000 in payments from third-party networks consisting of over 200 transactions within one calendar year, then you’ll receive Form 1099-K for that tax season. FYI: This only applies to methods that involve card payments, so ACH, Zelle, and Wires are excluded.

The future of the 1099-K Form in 2023: What's new?

Let’s circle back to the new changes the IRS introduced, which, like we alluded to, will affect who receives a 1099-K next year.

Currently, you will get Form 1099-K if you received more than $20,000 in payments from third-party payment networks, AND if that amount included over 200 individual payments.

Starting next year, you’ll be issued Form 1099-K if you receive over $600 in payments for the 2023 calendar year. There is no minimum amount of individual payments, so whether you received one payment of $600.01 or 601 payments of $1, you’ll still get a 1099-K.

Be warned: Even if your transactions aren’t strictly business related, you still might receive a 1099-K, and those transactions will be reported on the Form. Whether you made $600 in Etsy sales or your friend was simply just Venmoing you back for Coldplay tickets, Form 1099-K doesn’t discriminate.

How does this affect me?

Okay, but let’s assume you are a small business owner, freelancer, or contract worker who receives payments via online third-party payment processors, and you’re not just someone attending an overpriced concert. How do these IRS changes affect you?

If you are receiving all of your revenues from a third-party processing payment provider (i.e. no direct sales such as cash, ACH deposits, or checks), you may be required to update your bookkeeping process from net receipts to gross sales revenue recognition.

“Net sales” is your total income from sales, with discounts, returned goods, and allowances subtracted. “Gross sales” is your total income from sales without subtracting any deductions.

Form 1099-K includes the gross amount of all reportable payment transactions, and may include sales tax collected on your behalf. Also, payment processor fees, refunds, and returns have not been deducted from this number. This means that if you are currently categorizing only net receipts received from a third-party provider, you will need to start tracking processing fees and refunds separately.

If your 1099-K for 2023 does not match your income reported on your 2023 tax return, you may be required to justify the discrepancy to the IRS, especially if the sum of all 1099-K gross amount of transactions (Box 1a) exceeds the total gross receipts reported on your tax return. Your tax preparer would be the best person to contact about this change regarding your 2023 taxes due in March or April 2024.

(and create unique links with checkouts)

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada. See Wave’s Terms of Service for more information.

What's the difference between a 1099-K and a 1099-NEC?

If you already know of the 1099-NEC, you might be thinking, “Hey, that sounds pretty similar to the 1099-K. Aren’t they, like, the same thing?”

The answer: no, because they come from different sources.

You might receive a 1099-NEC from a specific business you’ve done work with if they paid you $600 or more within that tax year, whether you were paid in cash, check or through electronic payments. 1099-K is specifically for payments from third-party networks and includes income information from all transactions (aka not just one customer).

But beware! Income shown on a 1099-NEC might also be counted on your 1099-K. That’s why it’s important to keep up good bookkeeping habits so you can make sure you aren’t reporting the same income twice on your income tax return (or paying tax twice on the same income).

Why shouldn’t I accept nontaxable card payments?

Now, we’re going to hit you with a very compelling reason why you should never accept nontaxable payments through any credit or debit card processing related to your business. BTW, when we say “nontaxable payments,” we mean payments unrelated to your business.

Let’s go back to the concert tickets example. Whatever payment processor you use probably doesn’t allow you to separate business and personal transactions, so all that money your friend Venmoed you for the concert tickets will show up on your Form 1099-K, even though they’re unrelated to your business. It’s easier to separate your business and personal finances now than give yourself more work at tax time.

Reporting the 1099-K Form on your tax return

Let’s go over your game plan for the 2024 tax season: how you’ll report the 1099-K Form for 2023 on your tax return.

So, the amount of 1099-K forms you receive depends on how many third-party settlement entities you use. You might get one from Wave and one from PayPal, for example. To find out your total business income, you’ll need to add up the income reported on your 1099-K Form(s), along with any other income, including cash, checks, gifts, or goods and services received as payment.

You’ll report your total business income on Forms 1120, 1120S, or 1065 if you are a corporation or partnership, or on Form 1040 using Schedule C if you are a sole proprietorship.

"I was using an old-school bookkeeping book that my accountant gave me. The process was me literally printing out all of my invoices for the month, looking at all of my paper receipts, all of my credit card statements—it was terrible. I dreaded sitting down and having to do all that stuff myself. So I hired Wave Advisors to take care of it for me and threw the book away."

Kaleigh Moore,

Freelance Writer

How to correct information on a 1099-K Form

If something seems fishy about your 1099-K or the numbers aren’t adding up, you should go back and check if the information on your 1099-K matches your records. (This is why it’s so important to practice good bookkeeping and keep your personal transactions separate!)

If there’s something totally wrong with these numbers, then you should contact the payment processing entity that sent you the 1099-K—you can find their information in the bottom left of the form. This could be the result of a common error, like making changes to your business structure or someone else having access to your third-party network account.

If you received a 1099-K for a personal item, the IRS has instructions on their website about the best action to take.

Moving ahead with the 1099-K

Congratulations on making it to the end of this article and preparing yourself for both this tax season and for the changes coming to 1099-Ks in the 2024 tax season (that’s what we call getting ahead)! Now, getting Form 1099-K in the mail next January won’t seem so bewildering. When you think about it, it’s just another piece of paper that’ll help make sure your numbers are accurate (and help you stay out of trouble with the IRS).

Remember to keep records of your business income, including income that may be reflected on Form 1099-K—this helps prevent you from recording the same income twice, makes it easier for you to detect any other discrepancies, and can help back up the information reported on your income tax report.

If you are currently categorizing only net receipts received from a third-party provider, you will need to start tracking processing fees and refunds separately this year. I know we’ve said this, like, a million times already, but remember to keep your business transactions and personal transactions separate, too.

If you have questions about Form 1099-K or need help adjusting your bookkeeping process, our Wave Advisors are just a call away. What is a Wave Advisor, you ask? Wave Advisors are trained in-house professionals who can give you expert bookkeeping, accounting coaching, and tax preparation services year-round.

Don’t know what you don’t know? Don’t worry, we don’t judge.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.