Customer profile: RateHub.ca

Mortgage rates are kinda like accounting in one respect: Though they’re essential, they don’t make for very good cocktail party conversations. So how does Alyssa Richard, who founded mortgage site RateHub.ca, keep things interesting? Kite surfing!

“It’s such an incredible sport!” says the Toronto-based entrepreneur. “In May I am heading back to Maui for a week-long kite camp for entrepreneurs in the tech space, called the MaiTai. I still can’t believe an event like this exists. It combines my three passions in the most beautiful place on earth.”

Still, right now RateHub is what’s got Richard’s adrenaline pumping.

“We bring the most competitive mortgage rates in Canada offered by banks and mortgage brokers to one place, so mortgage shoppers can save time and money,” Richard says.

“I want RateHub to add complete transparency to the mortgage process. I am so passionate about education and want our users to understand the decisions and tradeoffs they are making between mortgage products, providers and rates.”

RateHub is currently exclusively in Canada, with most of its business in Ontario. In addition to straight-up rate comparisons, RateHub.ca’s “Education Center” covers concepts like amortization for first-timers. But overall, Richard’s goal is the same whether it’s your first home or your fifth: “We believe that finding the best mortgage rate should be straightforward, and our website has been designed with that in mind.”

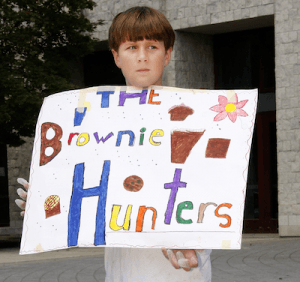

Richard actually has a knack for keeping entrepreneurship cool. Her first co-venture after university was a day camp for students in grades 4-8 called Break into Business. The camp takes kids through their very first entrepreneurial ventureand teaches them the business basics along the way. “One of my favorite businesses run last year was ‘Celebrity Smoothies—Famous for being Famous.’ The young owners couldn’t keep their celebrity-themed smoothies on the shelf.” The top sellers? “Miley Citrus” and “Melon Degeneres.”

Since Richard is making entrepreneurs out of fourth graders, we wondered what learnings her day camp could pass on to adult entrepreneurs.

Lesson one: You can’t create your product and business for yourself. Your decisions must be driven by your customers

“It’s hard to separate your passion for your business and products, from what your customers ACTUALLY want and need. Our campers launch their businesses on Queen’s University campus [in Kingston, Ontario] and are selling to professors and university staff members who want lunch items, BBQ, pizza, drinks. Despite reminding our campers of this, there are always one or two groups who sell the giant freezies. NO customers want the giant freezies and the campers are always left with a cooler filled with them.”

Lesson two: The power of direct sales

“The businesses that have the biggest lines on the day of launch have the boldest sales men and women. Campers that fearlessly approach their customers, clearly outline the value proposition (of their Brownie Hunters Bake Sale) with enough charm to hook the customer are always most successful. Sales and cold calling are never easy but at Break into Business and RateHub I am continually reminded just how effective they are.”

Before & after

“Before Wave, I would rather be dating Charlie Sheen than do my accounting.”

Richard’s path to Wave is a familiar one. “Before Wave we had some pretty spreadsheets and some not so pretty receipt piles. The stuffed box on the Wave homepage always makes me laugh, because it reminds me of a previous life I’ve been able to leave behind. 😊”

As most entrepreneurs find out sooner or later, spreadsheet accounting doesn’t usually work out that well. “As a startup, we ignored keeping up with our accounting for the first couple months and had been mixing personal and business expenses on our credit cards. With our year end approaching we had to clean up our act. With Wave, we soon had our expenses dragging and dropping and under control.”

“Wave definitely saves us time and even better….IT SAVES US $$$$$! We update our books at the end of each month and focus on our business in between.”

Company info

RateHub.ca, “Connecting you to Canada’s best mortgage rates” alyssa.richard@ratehub.ca Twitter.com/RateHub_CanadaFacebook.com/RateHub 1-800-679-9622 103 Balliol St., Toronto, ON M4S 1C8

Break into Business runs one week each summer. For more information, check out breakintobusiness.com.

Be a Wave featured customer

What’s your story? We’d love to help promote your business. If you’d to participate in our Wave customer profiles, please contact us at info@waveaccounting.com.

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.